中国储能网讯:日前据报道,日本贸易商伊藤忠商事株式会社向英国的能源存储和相关服务提供商Moixa公司投资500万英镑(704万美元),这个举措使伊藤忠公司可以将Moixa公司的“GridShare”聚合平台添加到自己的电池储能解决方案套件中。

在获得公用事业TEPCO公司的50万英镑投资之后不到一年,这笔最新的资金将有助于Moixa公司的国际市场的扩张,尤其是在日本市场,可以将GridShare平台推向当地的电池市场。

与此同时,伊藤忠商事将推广这一平台,利用人工智能根据行为模式、天气状况和市场价格优化电池性能,并将其添加到自己的Smart Star电池系统中。

伊藤忠商事投资500万英镑(704万美元)到英国的能源存储和相关服务提供商Moixa公司,并将采用Moixa公司的电池存储解决方案的“GridShare”聚合平台

伊藤忠商事自2013年进入住宅储能市场以来,预计将在2018年3月底之前在日本销售超过6000台9.8kWh Smart Star机组(其总量相当于55MWh),伊藤忠商事将在其产品上安装GridShare作为标准产品。Moixa公司将于2018年夏天使用该平台来聚合多个分布式电池的容量,以提供电网服务,包括降低在英国本地电网的高峰需求。Moixa公司每年将向系统主机或业主支付费用,允许供应商使用电池中的“剩余容量”来提供这些服务并获得收入。

伊藤忠商事工业化学部门总经理Koji Hasegawa表示:“Moixa公司在电池管理方面处于领先地位,我们很自豪能够投资并开展合作,进入日本迅速发展的储能市场。Moixa公司的GridShare将帮助我们的客户获得家用储能电池更多的价值,并将提供解决方案,帮助我们加快日本的低碳转型。”

Moixa公司最近从英国政府获得了25万英镑的资金,以扩大GridShare的推广和应用。现在将寻求扩大与日本公用事业和电动汽车制造商的合作,并为其市场场化的电网提供服务。

在日本,太阳能上网电价计划的十年期将于2019年到期。预计这将导致利用太阳能发电和储能系统产生的电力的自用电量增加。从2020年起,所有新建的日本住宅将被要求达到净零或零能源标准,这可能会促进储能电池的更多的应用。而在日本,大多数人仍然是购买土地建立自己的家园,而不是购买他人的现有住宅,因此太阳能发电和储能系统的应用将会更加广泛。

Moixa公司首席执行官Simon Daniel表示:“伊藤忠商事是全球电池市场的主要参与者,这一合作伙伴关系为我们扩大在日本市场的业务提供了一个真正的机会,并为许多全球电池公司提供GridShare技术。”据悉,Moixa公司还计划今年在美国和欧洲进行试验。

虽然日本拥有几家大型锂电池制造商(其中包括松下和索尼),但日本政府和主要公用事业商(目前也负责监管地区电网)近几个月来一直在寻求国外的能源存储供应商、创新的商业模式和技术。日本经济产业省(METI)和三井公司目前正在运行一个项目,以建立一个“虚拟发电厂”的用户侧聚合储能系统,将会采用东京电力、伊藤忠商事投资的Moixa公司,以及美国供应商Stem公司的技术。(中国储能网独家编译,转载请注明来源)

Japan’s Itochu will integrate UK-developed aggregation platform into own batteries

Published: 29 Jan 2018, 15:50

By:

David Pratt

Image: Moixa.

Japanese trading house Itochu has invested £5 million (US$7.04 million) into UK-based energy storage and related services provider Moixa, which will enable Itochu to add Moixa’s ‘GridShare’ aggregation platform to its own suite of battery storage solutions.

Less than a year after securing £500,000 of investment from major utility TEPCO, the latest funding will aid Moixa’s international expansion, not least in Japan where it will be able to launch GridShare to the battery market.

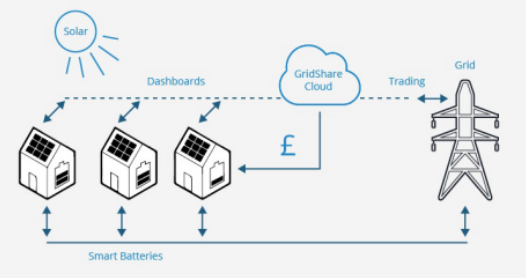

Meanwhile Itochu will promote the platform, which uses artificial intelligence to optimise the performance of their battery based on their patterns of behaviour, the weather conditions and market prices, as well as adding it to its own Smart Star battery systems.

Since entering the residential energy storage market in 2013, over 6,000 9.8kWh Smart Star units – equivalent to around equivalent to 55MWh - are expected to be sold in Japan by the end of March 2018. Itochu will then install GridShare as standard on its products by the summer of 2018. In the UK, Moixa is using the platform to aggregate the capacity of multiple distributed batteries to be able to provide grid services, including lowering peak demand on local networks. System hosts or owners are paid a fee annually by Moixa for allowing the provider to use ‘spare capacity’ in their batteries to provide these services and earn revenues.

Koji Hasegawa, general manager of the industrial chemicals department at Itochu, said: “Moixa has pioneered battery management, and we are proud to be investing and working together to target the rapidly growing energy storage market in Japan.

“Moixa’s GridShare will help our customers get more value for their home batteries and will offer solutions to help our partners manage Japan’s low-carbon transition.”

The British battery firm, which recently secured £250,000 from the UK government to expand GridShare to include aggregation of third party units for the first time, will now seek to expand its partnerships with Japanese utilities and electric vehicle manufacturers, and to market services to electricity networks.

In Japan, the 10-year period for the solar feed-in-tariff scheme will begin to expire in 2019. This is expected to lead to an increase in self-consumption of power that is generated using solar systems and energy storage systems, as one Japanese company, Solar Frontier, told Energy-Storage.News in 2016. From 2020, all new Japanese homes are also expected to be required to meet net zero or zero energy standards, something which could have a strong impact on uptake of batteries at household level in a country where the majority of people still buy a plot of land on which to build their own home, as opposed to moving into recently-vacated exsiting residences.

Simon Daniel, chief executive of Moixa, said: “Itochu is a major player in the global battery market and this partnership provides a real opportunity for us to expand our business in Japan and provide GridShare technology to many global battery companies.”

The company is also planning trials in the US and Europe this year.

While Japan has several large manufacturers of lithium batteries headquartered in the country, including Panasonic and Sony, Japan’s government and its major utilities, which currently also oversee the regional electrical grid network, have been looking abroad in recent months for energy storage providers with new or innovative business models and technologies. In addition to the TEPCO and latterly Itochu investments into Moixa, Japan’s government Ministry of Economy, Trade and Industry (METI) and Mitsui are currently running a project to create a ‘virtual power plant’ of aggregated behind-the-meter energy storage systems using technology from US provider Stem Inc.